By: Katrina Stroh, Vice President

While 2024 marks an unprecedented year for political ad spending, this doesn’t mean your ad campaign needs to go dark during this time. For advertisers looking to maintain a relevant presence with their consumer base, while staying on budget, a thoughtful and balanced approach to media strategy is key. In this guide we will explore the key considerations that advertisers should take note of, as well as provide actionable strategies for brands looking navigate the evolving environment.

Implications of Political Advertising

Let’s first dive into four implications of political advertising:

- Political advertising is costly: There is increased pressure on inventory which leads to scarcity and higher ad costs across channels most impacted.

- Ad preemption takes place: Broadcast and Cable TV will bump non-political ads and prioritize political advertisers at a premium rate.

- Audience attention can waver: Consumers may avoid certain channels or limit usage to avoid political fatigue.

- Brand safety is a challenge: The election season poses multiple brand safety threats, manifesting in the form of possible adjacency to negative political content and/or to political disinformation and misinformation.

Understanding Political Spending Patterns

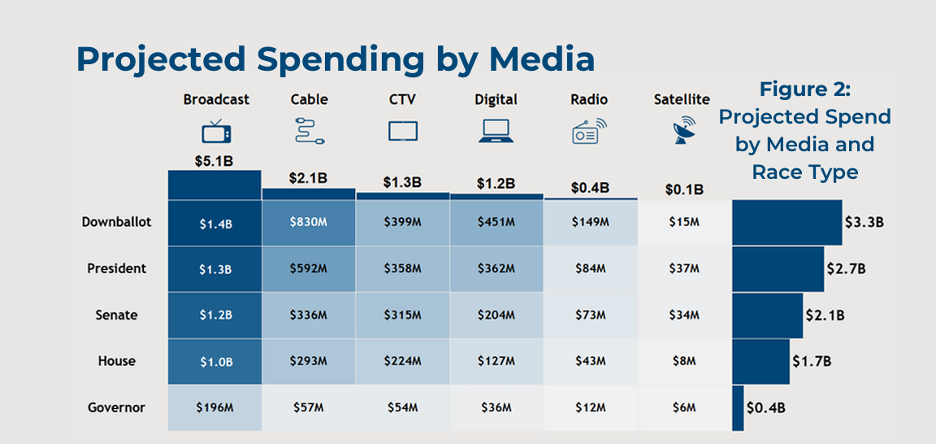

This will be a historically high spending year with the 2024 political ad spend projected to be $10.2 billion, a 13% increase from 2020. Here are a few stats to note:

- Broadcast TV, Cable TV and CTV are the top three channels expected to receive political ad spend

- YTD, Cable and Broadcast have accounted for 80% of spend with the remaining 20% against CTV (10%), Digital (8%) and Radio (2%)

- Linear Television accounted for 73% of political spend in 2022, and 76% of political spend in 2020 (the last Presidential Election)

- 70% of political spending is anticipated after Labor Day making September to Early November the most heavily impacted period with spend gradually increasing more and more toward Election Day.

50% of the 2020 year’s political dollars ran in the 30 days leading up to the election, with 25% running in the ten days leading up to Election Day

Key States and Audiences

Several states and audiences will play a massive role this Election year:

- 48% of political spend in 2024 has been isolated to 5 states – Ohio, California, Pennsylvania, Montana, and Michigan

- Meanwhile, key battleground states will receive the 76% of the Presidential election dollars: Michigan, Pennsylvania, Nevada, Georgia, Arizona, Wisconsin

- Key Senate races and divisive ballot measures will also lead to high volumes of political advertising in cities like Las Vegas, Philadelphia, Phoenix, Reno, Pittsburgh, Missoula, Billings, Boston, Wilkes Barre-Scranton, Butte-Bozeman, Detroit, Los Angeles, Charlotte, Atlanta, Cleveland, Cincinnati, Harrisburg, DC, and Raleigh-Durham

- Spanish language broadcast is expected to increase 9% cycle-over-cycle to $121M in 2024, largely due to the number of competitive races in states with high Spanish-speaking populations such as Arizona, Nevada, Texas, and Florida

- Washington State is likely to see lighter political presence across digital media as several major publishers (i.e.: Google, Meta, The Trade Desk,) no longer accept state and local political ad campaigns in Washington State due to excessive ad-transparency reporting law requirements.

Will Political Adjacency Impact Brand Perception?

Advertisers may have concerns over placing their brand messaging adjacent to political messaging, as research from 2016 has suggested that political ads (even those with positive messages) can generate negative emotions in consumers who have a difficult time compartmentalizing these feelings, creating a negative “hangover effect” on subsequent brand advertising. This led to adjacent brands seeming 32% less relevant, 29% less entertaining and 27% less appealing when it follows a political ad. To avoid this, advertisers may want to take measures to avoid adjacency to political ads and content.

How Will Non-Political Advertisers Be Affected?

We believe there is ample opportunity to have a media presence during the political season as not all channels are truly impacted by political ad spending. Some channels are more impacted than others, while others don’t allow political ads at all. Linear TV will be costly and congested, with policies that prioritize premium priced political ads over standard advertisers. However, in the digital world they do not offer political advertisers the same priorities; instead, it is a more even playing field with similar access to inventory and less direct impacts on pricing. To best limit impact or interruption to ad schedules, our suggestion would be to lean harder into environments that ban political and/or have limited political spending during this two-month timeframe.

Political Ad-Free Environments

Media Channel Recommendations

We have several recommendations for advertisers below, categorized by media channel:

- Linear TV: Plan for the largest rate increases and inventory shortages. We recommend limiting spending on Broadcast and Cable TV during this timeframe.

- To minimize cost increases and inventory bumps, we recommend shifting away from news or prime dayparts, cable news networks and removing :15s from the buy.

- If possible, we recommend pulling off-air in the two weeks leading up to the Election.

- Connected TV: Plan for higher rates across CTV during this timeframe and look for ways to gain efficiency through increased spending in online video.

- Since digital video is auction-based inventory, rates will be higher, but inventory will still be available, offering a strong alternative to Linear TV.

- Online video offers lower rates than CTV and will offer advertisers an opportunity to trade down inventory to keep pricing lower.

- Amazon has banned all political ads and will serve as a safe environment for those looking to avoid any political adjacency.

- Social: Meta will receive the lion’s share of political spending in social and costs will likely increase.

- We recommend diversifying your social mix during this timeframe by shifting some spend away from Meta and leaning harder into channels that have banned political ads, such as TikTok, Pinterest or LinkedIn.

- Other: We also see Search, Digital, Out-of-Home (OOH) and even Radio/Audio as key channels offering plenty of inventory that won’t be saturated with political ads.

- Radio/Audio: Most political spending will be on news/talk station formats, therefore shifting ad inventory toward music formats or leveraging public radio (NPR) where political ads are banned will offer best opportunity to avoid adjacency.

- OOH: Due to the longer-term contracts and production timelines, this channel doesn’t see much political spending.

- Search: Paid search rankings are based on a variety of factors beyond just bid, including landing page relevance, therefore, political ads might have difficulty gaining steam across most consumer focused category keywords. For keyword categories that may have political implications, lean harder into branded search terms during this time.

Media+ is here to help you navigate your paid media programs across the upcoming election by avoiding channel pitfalls, limiting political adjacency and maximizing your ad budgets through a thoughtful optimization strategy.

Sources

- AdImpact 2023-2024 Political Spending Report

- AdImpact 2022 Cycle in Review

- AdImpact Political Lead Generation tool. All political spend YTD (as of 06/04/2024).

- Standard Media Index 2020 – 2023 Advertiser Spending

- Stagwell x The Harris Poll Brand Safety Consumer Research, March 2024

- Magna Global Political Forecast, May 2024

- Katz, Local Vote – https://view.genial.ly/5ea310a6666fa90d800697c4

- NBCNews, Political ad spending for 2024 – https://www.nbcnews.com/politics/2024-election/political-ad-spending-2024-expected-shatter-10-billion-breaking-record-rcna104402